Digital Gold vs. Physical Gold: Deciphering the Better Investment

Gold has long been revered as a haven and a hedge against inflation. Traditionally, investors have turned to physical gold in the form of bars, coins, or jewellery. However, digital gold has emerged as a convenient alternative due to technological advancements. Both options have pros and cons, so choosing between digital and physical gold is a matter of personal preference and investment strategy.

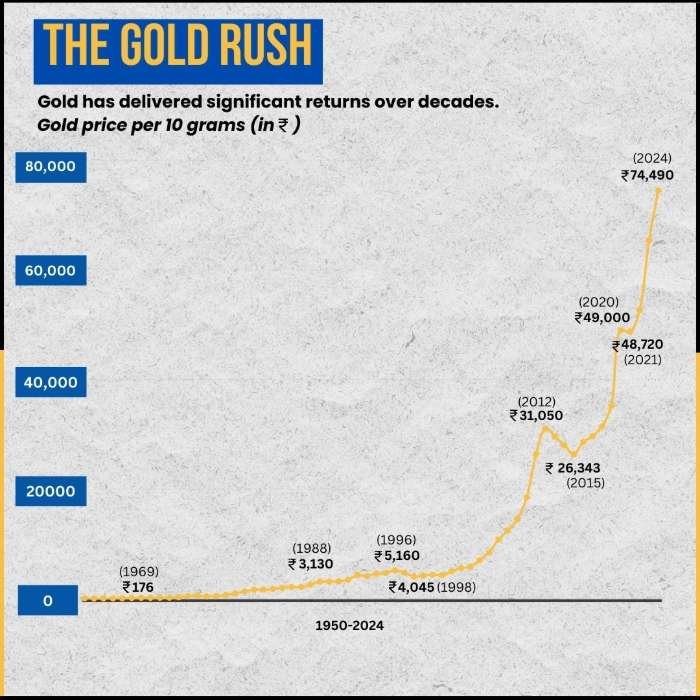

Gold Prices Over the Past Years

| Year | Price per 10 grams (INR) | Return |

| 1950 | 99 | – |

| 2000 | 4,400 | 4,344% |

| 2020 | 49,000 | 1,013% |

| 2024 | 74,490 | 52% |

The historical price data of gold showcase its substantial appreciation over time. For instance, in 1950, gold was quite modest at Rs 99 per 10 grams. By 2024, it had surged to Rs 74,490 per 10 grams, providing a remarkable return of 750 times the original value. This translates to a Rs 1,000 investment in 1950, growing to Rs 7.5 lakh.

From 2000 onwards, when it was priced at Rs 4,400 per 10 grams, it has provided a significant return of approximately 1,500%. During the 2020 pandemic, prices rose sharply to Rs 49,000 per 10 grams due to its reputation as a “haven” asset during economic uncertainty. This trend continued post-COVID, with prices reaching new highs in 2023 and 2024.

However, it’s important to note that gold prices can be quite volatile. Factors such as economic instability, inflation rates and geopolitical tensions have all contributed to fluctuations in gold prices over the years.

Physical Gold: Tangibility and Tradition

Physical gold holds a significant allure due to its tangibility and historical value. Here are some key points to consider:

1. Tangible Asset: Owning physical gold provides security as you physically possess the asset. It can be held in coins, bars, or jewellery, adding to its aesthetic appeal.

2. Cultural Significance: Gold jewellery, in particular, holds cultural and emotional value in many societies. It serves not only as an investment but also as a cultural symbol and heirloom.

3. Liquidity: Physical assets can be easily sold or traded globally, although the process may involve higher transaction costs and logistical considerations.

4. Storage and Security: Storing physically safely can be a concern, as it requires secure facilities to guard against theft or damage. This adds to the overall cost and effort of ownership.

Digital Gold: Convenience and Accessibility

The advent of digital gold has transformed the investment landscape, offering unique advantages:

1. Ease of Access: Digital gold platforms allow investors to buy and sell gold instantly with a button, offering unparalleled convenience.

2. Fractional Ownership: Unlike physical gold, which typically involves purchasing whole bars or coins, digital gold platforms often allow fractional ownership, making it accessible to a wider range of investors.

3. Lower Costs: Investing in digital gold can sometimes be cheaper than buying physical gold, as there are often lower transaction fees and storage costs.

4. Security: Digital is secured through blockchain technology, which offers transparency and reduces the risk of fraud or theft associated with physical storage.

Determining Between Digital and Physical

The decision between digital and physical gold hinges on several factors:

1. Investment Goals: Physical gold may be more suitable if you value tangibility and cultural significance. It appeals to those seeking a physical store of value or collectors of rare coins and jewellery.

2. Convenience: Digital gold is ideal for investors who prioritize convenience, accessibility, and the ability to trade quickly. It suits those looking to diversify their portfolio with minimal hassle.

3. Risk Tolerance: Consider your comfort level with the security risks associated with each option. While physical may pose risks related to storage and authenticity, digital carries its risks related to cyber threats and platform reliability.

4. Cost Considerations: Evaluate the total cost of ownership, including transaction fees, storage costs, and potential premiums. Depending on your investment strategy, digital may offer cost advantages.

Comparative Analysis: Performance and Trends

To illustrate the performance trends and considerations between digital and physical gold, let’s examine some hypothetical data and analysis:

Historical Performance Comparison

Volatility: Historical data suggests that physical gold tends to experience lower volatility than digital, which can be influenced by market sentiment and technological factors.

Cost Efficiency: Over time, digital has demonstrated cost efficiencies due to lower transaction fees and operational expenses, whereas physical gold may incur higher costs related to storage and handling.

Investor Preferences

Preference Shifts: Recent surveys indicate a growing preference among younger investors for digital ones, driven by their convenience and compatibility with digital investment strategies.

Risk Perception: Investors perceive different risks associated with each option. Physical assets may involve storage and authenticity risks, but digital assets face technological risks such as platform security and regulatory compliance.

Conclusion

The choice between digital and physical gold ultimately hinges on individual investor preferences, risk tolerance, and investment objectives. Physical appeals to those valuing tangible assets and cultural significance, whereas digital gold offers convenience, accessibility, and potentially lower costs. Understanding these dynamics and reviewing historical performance can empower investors to make informed decisions aligned with their financial goals.

In conclusion, digital and physical have merits and appeal to different investor profiles. By weighing the advantages and drawbacks of each, investors can determine which option best suits their unique investment strategy and risk appetite.

Gold ETFs Whether digital or physical, an investment portfolio with around 10% —20% gold is considered healthy. This helps diversify the portfolio and hedges against volatility, currency risk, and inflation risk.