Stabilizing Pakistan’s Economy: $7 Billion IMF Deal Amid Debt and Inflation Challenges

Pakistan and the IMF have agreed on a 37-month, $7 billion Extended Fund Facility (EFF) to build on 2023’s economic stability.

The EFF aims to strengthen fiscal and monetary policies, broaden the tax base and improve State Owned Enterprises (SOE) management.

Pakistan’s economy, a developing country in South Asia, is complex in terms of challenges and opportunities.

Driven by agriculture, textiles, and a growing service sector, it faces growing inflation and political instability.

External debts and reliance on foreign aid also continue to pose significant hurdles.

Table of Contents

Composition and sources of Pakistan debt

Pakistan’s creditors fall into four categories: multilateral debt, Paris Club debt, private and commercial loans, and Chinese debt.

Pakistan’s debt to multilateral institutions totals $45 billion, with main creditors particularly the World Bank and Asian Development Bank.

Pakistan owes $8.5 billion to the Paris Club, repayable over 40 years at under 1% interest, mainly to Japan, Germany, France, and the US.

Pakistan’s $27 billion Chinese debt includes $10 billion bilateral, $6.2 billion to public enterprises, and $7 billion in commercial loans.

Pakistan’s private debt includes $7.8 billion in Eurobonds and Sukuk bonds. Foreign commercial loans total nearly $7 billion, mainly owed to Chinese institutions.

Inflation in Pakistan

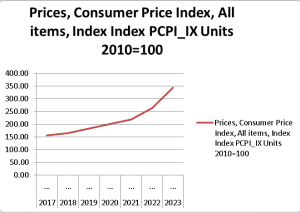

The Pakistan Rupee has been depreciating against major currencies, increasing the Consumer Price Index (CPI).

This depreciation has increased the cost of imported goods and services, contributing to overall inflation.

| Consumer Price Index: All items | |

| Units | |

| Base Year | 2010=100 |

| 2017 | 156.9113459 |

| 2018 | 164.8793939 |

| 2019 | 182.3209327 |

| 2020 | 200.078979 |

| 2021 | 219.0789001 |

| 2022 | 262.618334 |

| 2023 | 343.4210793 |

Pakistan is currently the country with the highest inflation in Asia. Food inflation has been a major concern, with rising prices of staples like wheat, sugar, and cooking oil.

Increases in energy prices, including fuel and electricity, have contributed to higher overall inflation.

IMF Program Targets Stability, Growth and Reforms in Pakistan

The Pakistani authorities and IMF have agreed on a staff-level agreement for 37-month Extended Fund Facility (EFF) worth around $7 Billion.

This program aims to build on the 2023 Stand-by Arrangement, promoting macroeconomic stability and inclusive growth.

Other goals include fiscal consolidation, tax reforms, increased social protection through the Benazir Income Support Program (BISP), and improvements in SOE management.

The program emphasizes sustainable public finances, reduced inflation, and enhanced external buffers.

Conclusion

Pakistan, a country with 240 million people, faces challenges of high inflation, political instability and significant external debt.

The concern is that a nuclear-armed country may be unable to meet its external debt obligations. To avert such a scenario, Pakistan needs to continue supporting the IMF.

The country really needs to increase its tax-to-GDP ratio, which should be above 15%, to fund necessary public services and state expenditures.

Pakistan eventually needs to reduce the country’s high inflation and needs to work on bringing political stability.